|

|

|

|

|

|

|

||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

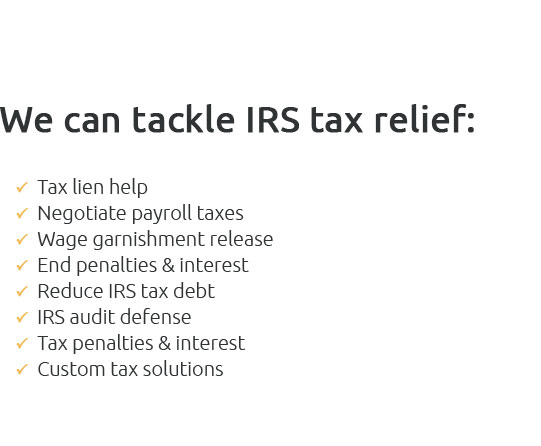

Struggling with tax debt can feel overwhelming, but with our expert tax debt attorneys by your side, you can navigate the complexities with confidence; we specialize in securing IRS debt forgiveness, transforming your financial burdens into a manageable path forward, and empowering you to reclaim your peace of mind-because you deserve a future free from the shackles of past tax woes.

https://www.irs.gov/newsroom/home-foreclosure-and-debt-cancellation

The Mortgage Forgiveness Debt Relief Act of 2007 generally allows taxpayers to exclude income from the discharge of debt on their principal residence. https://www.taxpayeradvocate.irs.gov/get-help/general/cancellation-of-debt/

You must report any taxable amount of a canceled debt as ordinary income on IRS Form 1040 or IRS Form 1040NR tax ... https://www.irs.gov/forms-pubs/about-form-1099-c

File Form 1099-C for each debtor for whom you canceled $600 or more of a debt owed to you if: Current revision Form 1099-C PDF Instructions for Forms 1099-A ...

|